How does the integration work?

Book a demoWithin your PCMS, users can request AML checks by making tick box selections with the PCMS client contact details that is automatically uploaded to Verify365. This reduces duplication of data entry. When the results are available, the AML report is automatically uploaded to the AML module, ie. completing the ‘traffic light’ system of green for pass and red for fail.

You can auto file a copy of the AML report into this specific area as well adding a copy into the case manager file.

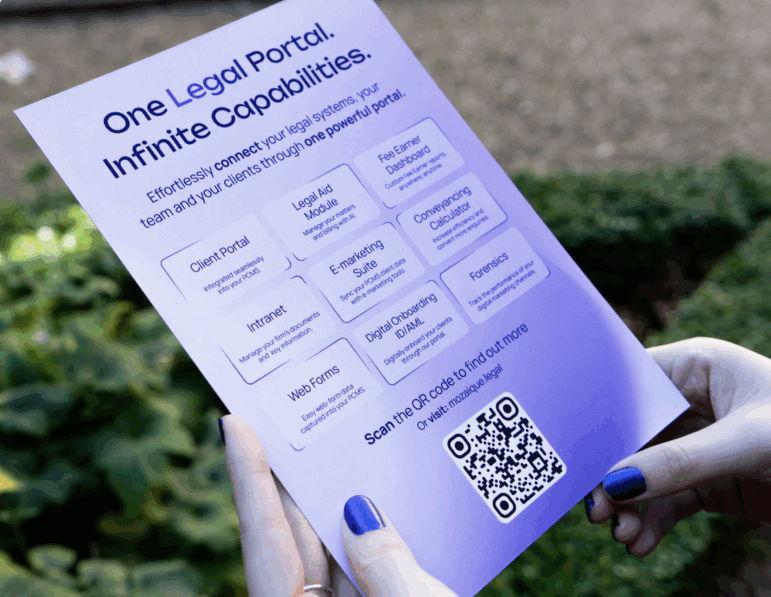

The key risk and compliance technologies offered by Verify365

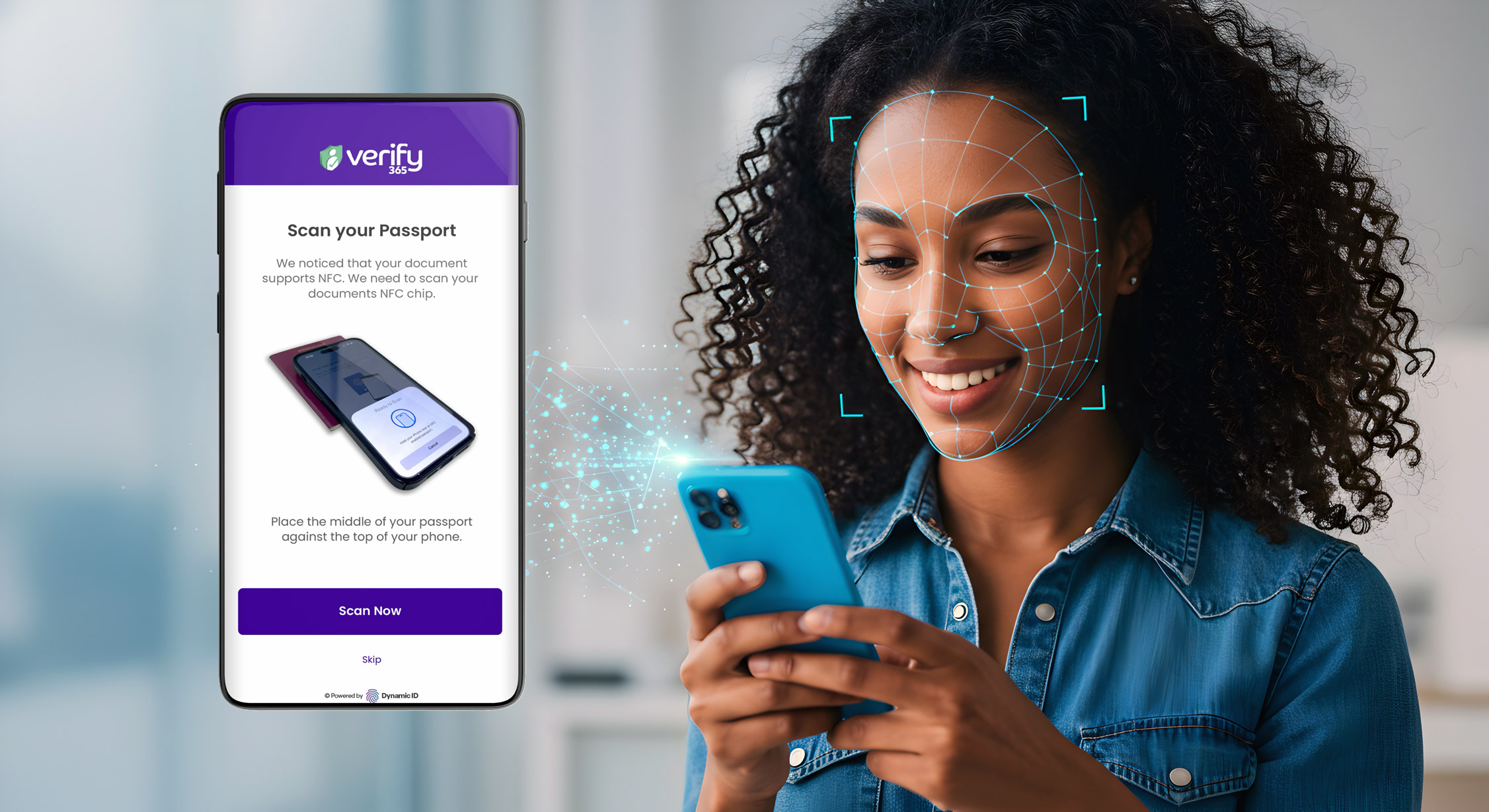

Verify365 Provides digital ID verification using proprietary DynamicID biometrics, document checks, and database searches, enabling automated and fast customer onboarding. DynamicID technology utilises AI for facial recognition and document authenticity checks and offers a single dashboard for managing verifications.

Verify365 provides automated global address validation against official data sources such as the Electoral Roll and Credit Reference Agencies, providing real-time address verification and formatted address outputs. This provides a facility for client document upload and OCR recognition of the documents uploaded as proof of address, or proof of ownership (conveyancing transactions).

Verify365 provides automated PEPs and Sanction checks with data generation in a constant live state, with real-time risk assessments of over 1,800 global watchlists, PEPs, and adverse media. Real-time risk screening – using AI, AML/CFT data is acquired in minutes, not days, with a single alert of all the information needed to make an informed decision, including teams of global data experts that review and edit problematic profiles and high-risk clients.

Verify365 provides fully automated digital checks for verifying a client’s source of funds using the most advanced open banking technology, aiding in compliance with AML regulations. This offers a unique source of funds analytics dashboard for real-time monitoring and reporting and provides a summary of “transactions of concern” for enhanced security.

Verify365 offers a comprehensive KYB and UBO verification service for purchasing reports on over 500 million companies world-wide based on specific requirements, aiding in informed due diligence. This provides global coverage, comprehensive datasets, real-time screenings, and a cloud-based dashboard for accessing live company data.

Verify365 enables the use of digital bank statements using Open Banking technology for identifying risks and preventing fraud during client onboarding. This provides real-time analytics of client’s financials, transaction analytics, and instant bank statement risk assessments, promoting an efficient workflow.

Designed to align with international regulatory standards, Verify 365 is an ideal choice for law firms operating in multiple jurisdictions or dealing with international clients, ensuring global compliance.

Security is paramount in client onboarding and compliance. Verify 365 employs advanced security protocols to protect sensitive client data, aligning with the highest industry standards.

Enhance your client onboarding process

Verify365 emerges as a leading solution for law firms seeking to enhance their client onboarding processes and ensure rigorous compliance with AML and other regulatory standards. Its blend of automation, accuracy, security, and global compliance capabilities makes it an invaluable asset for law firms aiming to streamline their operations and uphold the highest standards of client service and legal compliance. Accesspoint’s detailed integration enables a seamless process that removes duplication of data entry and automates the updating of results within the PCMS AML modules.